Major producers in Indonesia and Malaysia are looking at new markets ranging from Africa to Myanmar SEP 14, 2017īunge to buy 70 percent stake in IOI Corp unit for $946 million SEPTEM- “The market is perceiving that this takes them out of the M&A risk,” said Bill Densmore, senior director of corporate ratings at Fitch Ratings, noting that the share price had been elevated this summer by expectations of a takeover. Top palm oil firms facing EU firing rethink trade strategy.

a temporary dampener on Malaysia-Indonesia hopes for China B5?ĭr James Fry, LMC International - Globoil Presentation - Sept 17

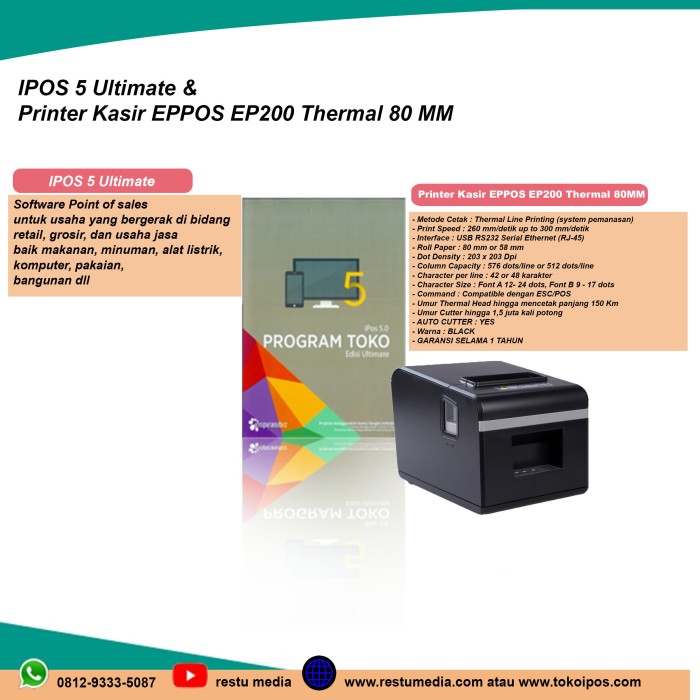

#Ipos 5 kasir supply full#

Heading to Paris-Brussels soon, so get in touch for a policy-trade views update.Ĭhina pushes for full scale bio-fuel ethanol E10 by 2020 - but experts point to feedstock limitations Or maybe more real estate deals for this palm and property giant? To be sure, palm exporters are ever worried about the EU market as palm volumes there have shrunk in non-energy uses and the all-important energy sector faces up to political and policy noises. Southeast-Asia based analysts write of IOI using its RM2.5 billion net gain/ RM4 billion proceeds to expand upstream (and this is expected to comply with tough sustainability - IOI has promised RSPO Next). The corporate surprise is the apparent de-industrialisation / de-integration of IOI Group as it sells its Loders Croklaan unit to Bunge (70% and the remainder may be sold within 5 years) and Bunge will be the buyer of half of the Malaysian group's palm oils.

More negative news is starting to build up on palm on enviro-social issues, in the widely expected cyclical news run up to the annual November RSPO meeting. Buyers ask when lower prices are coming, and they should keep an eye on recovery of production. Increased pessimism on biodiesel outlook is obvious among specialists in the palm sector - with US and EU short term policy hits on imports as well as medium-longer term concerns as China affirms domestic ethanol for its biofuel (it seeks to lift rural incomes, not add to money flow leakages) and technological disruption stares the need-subsidy-forever biodiesel segment in the eye. Bad flash floods even hit Penang in northern Peninsular Malaysia. : Dr James Fry presentation, China policy favours domestic ethanol, IOI de-integrates Loders Croklaan, trade tussles and the "unhealthy commodity" label, Brent Crude $55.14Įditor's note: I'm sitting in a rain-soaked and surprisingly cool Kuala Lumpur these few days - it's raining in the morning as well as the afternoon. Oil Resurrection Sets Stage for Another OPEC-Shale Clash in 2018 By Catherine Traywick, Heesu Lee, and Grant Smith Decem Malaysian palm oil price sheds 20% in 2017, - Palm oil prices have been trending downwards since November, after India raised import taxes on edible oils to their highest in more than a decade, cutting demand. : Malaysian palm oil price sheds 20% in 2017, Brent Crude $66.87 What's next? What can you do?īursa Malaysia crude palm oil futures fall on concerns over EU Parliament vote on RED II provisions Singapore (Platts). : EU Parliament has voted to exclude palm oil from the EU-RED. : EU Parliament has voted to exclude palm oil from the EU-RED, Brent Crude $69.38

0 kommentar(er)

0 kommentar(er)